Client Reviews – Read what other expats have to say

Why expats work with us:

We take the time to understand your unique financial goals and circumstances, tailoring a strategy that aligns with your needs. Whether you’re planning for retirement, investing, or managing day-to-day finances, our expert advisors provide solutions that work for you.

2. Independent and Transparent Advice

As an independent financial advisor in Berlin, we offer unbiased recommendations, free from conflicts of interest. You can trust that our advice is focused solely on what’s best for you, ensuring transparency and clarity at every step.

3. Expertise in the Expat and Local Markets

With extensive experience serving both expats and local clients in Berlin, we are well-equipped to navigate the complexities of the German financial landscape. Whether you’re new to the country or a long-time resident, our advisors understand the unique challenges you face and provide tailored solutions to help you thrive financially.

No knowledge + high taxes = less money

Most expats in Germany…

Do not use tax advantages when investing

have too little performance to tackle inflation

Do their investments quickly with apps or neobrokers

Have a high tax burden

Our clients…

Get their ETF savings plan subsidised

Are not dependent on the state pension

Benefit from tax refunds

Establish multiple sources of income

We help expats who wants to stay in Germany long-term

01. Diversified Investment Plan

02. Holistic Approach

03. Easy cost structure

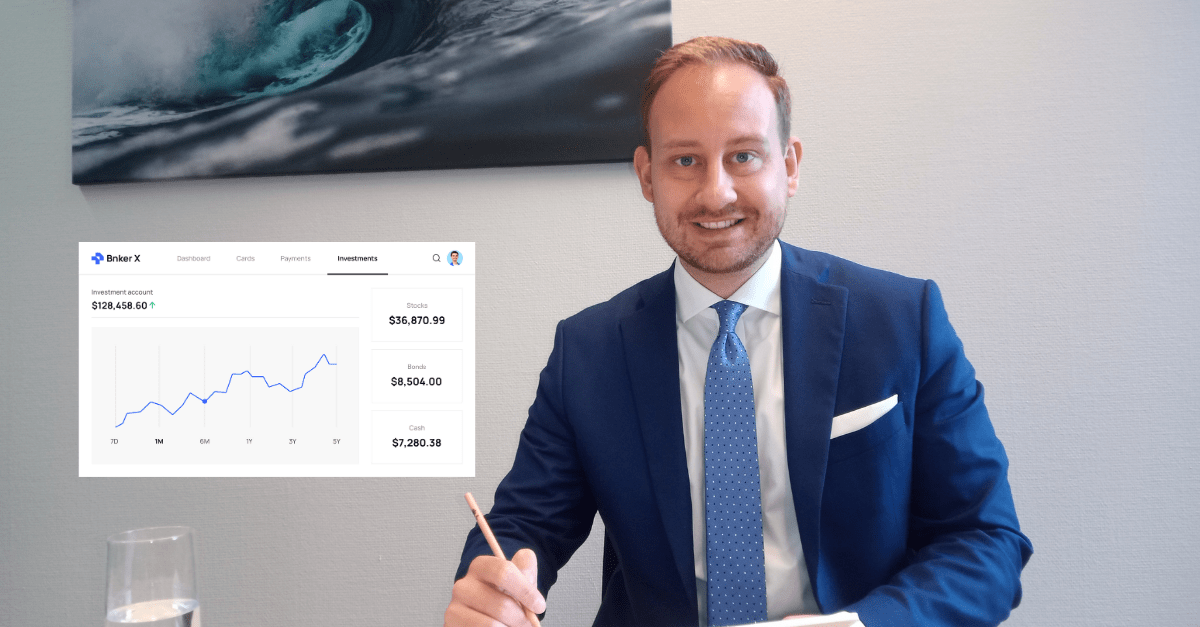

We are Finanz2Go!

We have been investing our own money in the stock market for years and in the strategies that we recommend to our clients

We do not work for any bank or company, but 100% independently for our clients

Certified and specialized on expats: Our financial consultants are accredited according to §34d and §34f GewO.

Book an appointmentFrequently Asked Questions

We provide independent investment consulting and pension planning tailored for expats.

We are independent financial consultants, as we do not work for any product provider like an insurance or a bank, so we do not have to sell any products. We are registered with the Chamber of Commerce and Industry as an independent financial broker.

This means that we are “fiduciary trustees” of our clients. Therefore, We are legally obligated to find suitable solutions for your situation and needs. In doing so, we draw on virtually the entire investment, finance, and insurance market. For us, this means true independence.

Yes you can. In Germany there are huge tax advantages and incentives for long term investing. Depending on what fits your individual situation we choose a framework that makes the most sense for you. Investment plans that you can deduct from your tax especially are interesting for high earners and freelancers due to their high tax burden.

Good pension plans have costs of about 1% of capital annually, which includes the cost of insurance, funds, and the advisor. We get paid by the insurance when you decide to do the plan. The conditions you get with us are exactly the same you get with the insurance directly, so you have no financial disadvantage by doing the plan with us, but of course the huge advantage is that we as independent brokers can scan the whole market, so you get the best available option.

We look at your individual situation and explain the available options to you. We also show you detailed numbers for the option you want to explore. Not only that, but we are there for you throughout the whole process, as you can tell from the outstanding reviews and recommendations from our clients.

The solutions in our consulting are structured in a way that you are flexible should you choose to leave Germany during your working life, and you can get your pension anywhere in the world.

Get expert knowledge for you as an expat

Finanz2Go – Your Financial Advisor in Berlin

If you’re living in Berlin and need help with your finances, you might want to check out Finanz2Go. This independent financial advisory service focuses on providing personalized advice that suits your specific needs. Whether you’re an expat, self-employed, or just starting out, they can help guide you through the financial landscape in Germany. Let’s break

Investment Consulting for Expats in Germany

Thinking about investing while living in Germany as an expat? You’re not alone. Many expats find the financial landscape here a bit tricky. Between understanding local tax benefits and figuring out how to blend German and international investment options, it’s easy to feel overwhelmed. But with the right guidance, you can make smart financial decisions

Financial Advisor for Expats living in Germany

Living in Germany as an expat can be an exciting adventure, but it also comes with its own set of financial challenges. Whether you’re just settling in or have been here for a while, understanding the local financial landscape is crucial. That’s where an expat financial advisor steps in. They can help you navigate everything

Mastering Portfolio Analysis: Strategies for Optimal Investment Decisions

Hey there! So, you’re looking to make smarter investment choices, right? Well, mastering portfolio analysis is where it’s at. This guide is all about breaking down those complex strategies into bite-sized pieces. Whether you’re just starting out or looking to refine your approach, understanding portfolio analysis is key to making informed decisions. It’s not just

How much does a financial advisor charge in Germany?

Ever wondered how much a financial advisor charges in Germany? Well, it’s not a one-size-fits-all answer. Fees can depend on a bunch of things like the advisor’s experience, what you need help with, and how they charge. Some might bill you by the hour, others might take a percentage of what they manage for you.