Financial Advisor in Berlin

You are working in Berlin and are looking for an independent financial advisor? We helped +500 expats in Berlin with their finances.

Read our Google ReviewsHow can we help you?

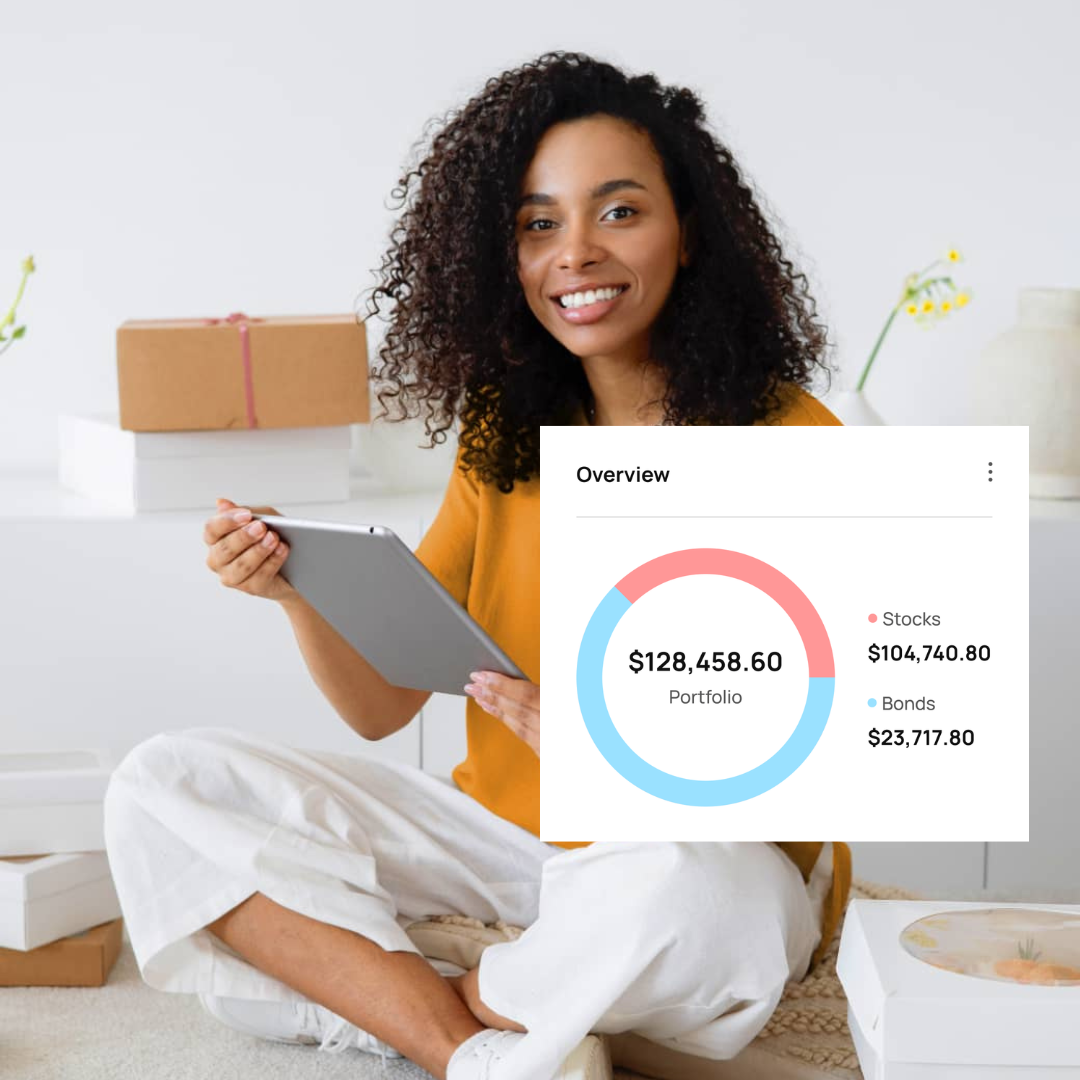

01. Investment Portfolio

We help you create a professional investment portfolio that suits your personal goals.

Book an appointment✅ One fair all-in-one fee of 0.7% p.a.,

✅ No hidden costs,

✅ No performance or exit fees.

02. Retirement Planning

Next to your investment portfolio, we try to close your pension gap. As independent financial advisors, we compare over 100 companies to help you find the most suitable pension plan.

Book an appointment

03. Asset Management

Do you already have an investment portfolio? Great! We objectively review your portfolio and manage it for you if you like.

Book an appointmentAbout Finanz2Go Consulting

At Finanz2Go Consulting, we believe that financial advisory in Berlin should be independent, transparent, and data-driven — never guided by sales targets or provider commissions.

Our mission is simple: to help expats and international professionals build long-term financial security through smart investment, pension, and insurance strategies tailored to the German market.

Based in Berlin and licensed under §34d and §34f GewO by IHK Berlin, we operate as independent brokers with a clear free model of 0.7% p.a. — ensuring that our incentives align with your financial goals, not with financial institutions.

Financial Advisor in Berlin

Looking for a financial advisor in Berlin?

Finanz2Go is an independent, English-speaking financial advisor supporting expats and international professionals in Berlin with clear, transparent, and commission-free financial advice.

⭐ Rated 4.8/5 on Google · Trusted by 500+ expats in Berlin

Independent Financial Advisor in Berlin

As an independent financial advisor in Berlin, we work exclusively in the best interest of our clients. Unlike banks or traditional brokers, we are not tied to specific financial products or providers.

Our advice is fully transparent and commission-free. This means every recommendation is based solely on your goals and financial situation — not on hidden incentives.

Finanz2Go operates under German regulatory standards and follows strict professional and compliance requirements.

Financial Advisory Services in Berlin

We help expats and international professionals in Berlin make confident financial decisions with a long-term perspective.

- Investment portfolio planning – globally diversified, risk-adjusted strategies

- Retirement planning – long-term financial security across borders

- Wealth management – structured planning to grow and protect assets

If you are looking for a financial advisor in Berlin who combines independence, structure, and clarity, our services are designed for you.

Financial Advisor Berlin for Expats & International Professionals

Berlin is one of Europe’s most international cities — and expats face unique financial challenges.

As a financial advisor in Berlin for expats, we specialize in working with clients who:

- Earn income in Germany while maintaining international ties

- Plan to stay in Germany temporarily or long term

- Prefer financial advice in English

- Value transparency over product-driven sales

Our advice is tailored to international lifestyles and long-term mobility — not one-size-fits-all solutions.

What Our Clients Say – Financial Advisor Berlin Reviews

Many of our clients found us while searching for a trusted financial advisor in Berlin. They value our independence, clarity, and transparent approach to financial planning.

Why Choose Finanz2Go as Your Financial Advisor in Berlin

- Independent & fee-only advice – no commissions, no conflicts of interest

- Specialized in expats – clear guidance for international professionals

- Local expertise in Berlin – combined with global investment knowledge

- Transparent process – you always understand your strategy

Our goal is not to sell financial products, but to help you make informed and confident financial decisions.

Financial Advisor Berlin – Fees & Transparency

Transparency is a core principle of our work as a financial advisor in Berlin.

We operate on a fee-only basis, meaning you always know what you pay, what you receive, and why a recommendation is made.

There are no hidden commissions, retrocessions, or long-term lock-ins.

Learn more about our transparent fee structure

Local Financial Expertise in Berlin

Finanz2Go is based in Berlin and works closely with clients living and working in the city.

We understand Berlin’s international workforce, professional landscape, and the financial questions expats face when building their future here.

Office: Berlin, Germany

Consultations: Online & in-person

Frequently Asked Questions About Financial Advisors in Berlin

Do I need a financial advisor in Berlin?

If you want structured, independent advice and long-term financial clarity — especially as an expat — working with a financial advisor can help you avoid costly mistakes.

Is financial advice regulated in Germany?

Yes. Financial advisors in Germany must comply with strict regulatory and professional standards.

Do you offer financial advice in English?

Yes. We specialize in advising expats and international professionals in English.

How much does a financial advisor in Berlin cost?

Costs depend on the scope of advice. As a fee-only financial advisor, we are fully transparent about pricing.

Talk to a Financial Advisor in Berlin

If you are looking for a trusted, independent financial advisor in Berlin, we would be happy to speak with you.

All our financial advisors are licensed by the IHK in Berlin

- §34d

- §34f

Certified and Regulated Financial Advisors in Berlin

At Finanz2Go Consulting, we place transparency and professional integrity at the heart of everything we do. Each of our consultants is certified through the IHK Berlin (Industrie- und Handelskammer Berlin) and registered in Germany’s official intermediary database for insurance and financial investment advisors.

Our official registration under § 34d and § 34f Abs. 1 Nr. 1 GewO (German Trade Regulation Act) ensures that every consultation meets national regulatory standards. This certification guarantees that we provide independent, commission-free advice in compliance with consumer protection and professional conduct requirements.

Finanz2Go is officially listed under the registration number D-FZH5-4AMPC-84 in the Vermittlerregister (German Intermediary Register), managed by the Deutscher Industrie- und Handelskammertag (DIHK). You can verify our credentials directly on the DIHK platform.

Our company’s regulatory supervision and certification details can be found in our Erstinformation, which provides full transparency regarding our legal basis, professional liability insurance, and registration status.

- Certified by: IHK Berlin – Chamber of Commerce and Industry

- Regulatory basis: §34d and §34f Abs. 1 Nr. 1 GewO (Germany)

- Supervisory authority: Deutscher Industrie- und Handelskammertag (DIHK)

- Registration number: D-FZH5-4AMPC-84

- Verification link: www.vermittlerregister.info

This official certification reinforces our mission to provide objective, ethical, and data-driven financial advice to expats and international professionals in Berlin — ensuring that every recommendation aligns with both regulatory compliance and your personal goals.