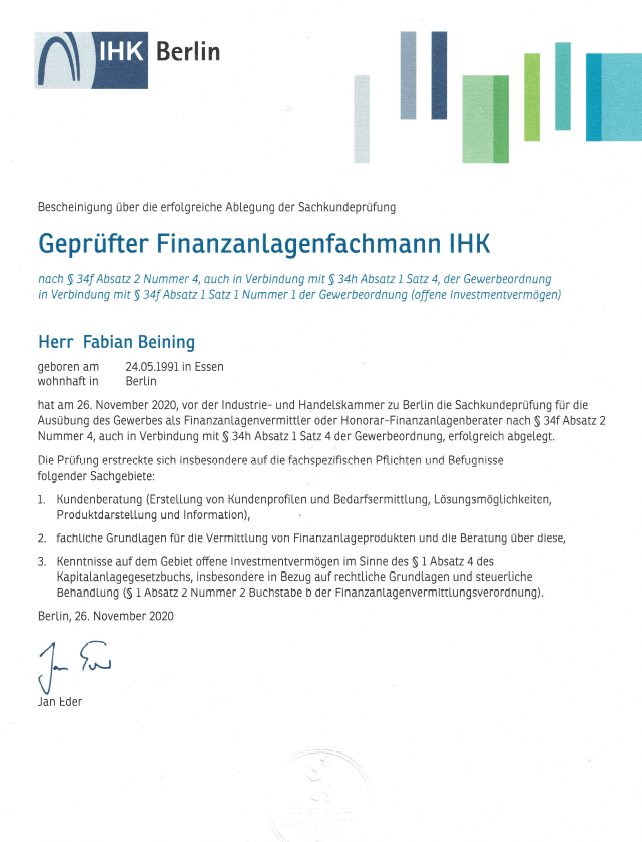

ihk certificate

IHK Certificate According to §34f GewO – Your Guarantee of Qualified Financial Advice

At Finanz2go, transparency and professionalism are core values. As required by German law, we are officially certified as Finanzanlagenvermittler under §34f GewO by the Industrie- und Handelskammer (IHK). This certificate confirms that we meet the legal requirements for offering independent financial investment advice and product mediation.

The §34f certification ensures that advisors have proven expertise in financial products, a clean regulatory record, and reliable financial conduct. It also requires ongoing training and strict compliance with German consumer protection and advisory standards.

With this certification, Finanz2go is authorized to advise on and mediate investment products such as mutual funds, ETFs, and closed-end investments — giving you the peace of mind that you’re working with a qualified and legally approved financial advisor in Berlin.

Understanding §34f GewO – The Financial Investment Intermediary Regulation

§34f of the Gewerbeordnung (GewO) is a section of German law that regulates the professional activities of financial investment intermediaries and advisors. It specifically governs individuals or companies offering advice on and the sale of financial products such as mutual funds, ETFs, insurance-linked products, and other investment instruments.

Key Requirements of §34f GewO

- Licensing and Certification

Under §34f GewO, financial advisors must be licensed by the local Industrie- und Handelskammer (IHK) (Chamber of Commerce). This certification demonstrates that the advisor meets all legal and regulatory requirements to provide advice and mediation services regarding investment products. - Qualification

To obtain this license, advisors must pass a certification exam that tests their knowledge of financial products, financial laws, and the regulatory framework surrounding investment advice. Continuous professional development and adherence to ongoing training are mandatory to ensure up-to-date expertise. - Regulatory Compliance

Advisors certified under §34f GewO are required to operate with transparency, follow ethical standards, and provide fair advice to clients. They must disclose all fees, commissions, and potential conflicts of interest, ensuring clients are well-informed about the products being recommended. - Consumer Protection

The regulation is designed to protect consumers by ensuring that financial products are offered by qualified professionals. It aims to prevent fraud and the sale of unsuitable products by requiring advisors to evaluate their clients‘ financial situation and risk tolerance before recommending investments. - Scope of Service

Advisors certified under §34f GewO are authorized to provide advice on a wide range of investment products, including:- Mutual funds

- Exchange-traded funds (ETFs)

- Private and public investment opportunities

- Securities and financial assets

- Insurance and Bonding Requirements

Advisors must also maintain professional liability insurance and a financial guarantee to cover potential damages caused by errors or omissions during their advisory services. This protects both clients and advisors in case of disputes or mistakes.

Why is §34f GewO Important for Clients?

For clients, the §34f certification offers reassurance that they are receiving advice from professionals who are not only qualified but also subject to strict regulatory oversight. By working with a §34f certified advisor, you can be confident that your investment interests are being handled responsibly and in compliance with German financial laws.