Pension Plan

Pension Planning for Expats.

Get a free comparison of the best pension plan for expats in Germany. We show you how you can save up to 48% in taxes with an optimized pension plan.

Trusted By

Pension Plan

We compare over 100 companies

Together we compare over 100 companies and offers to find the best pension plan for you.

Pension Plan

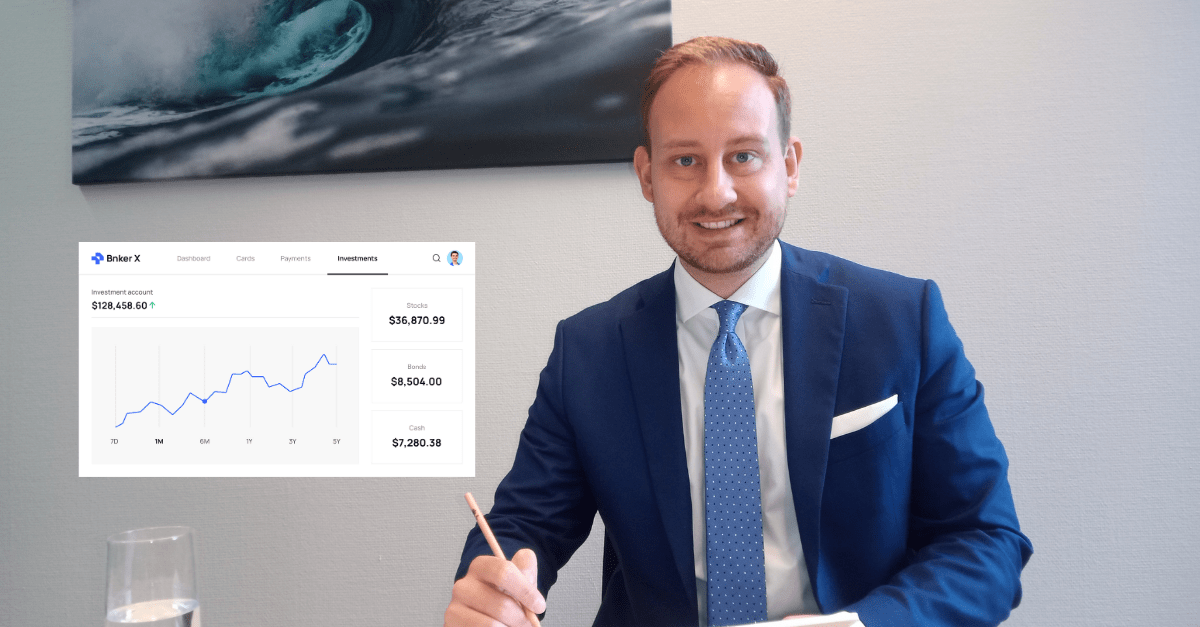

Optimize your investments for the future

We analyze your financial situation and compare over 100 companies to develop an investment portfolio tailored to your needs and wishes.

Pension Plan

03. Easy cost structure

The ongoing charges amount to only approx. 1 % p.a. – no front-end load, redemption fees, or performance-related costs.

Why you should consider a private pension plan in Germany?

German-Wide Online Consultation!

Finanz2Go offers independent, English-speaking financial consulting services accessible online across Germany.

Whether you’re in Berlin, Munich, Hamburg, or any other city, our certified advisors are ready to assist you remotely.

why Finanz2go

Start creating wealth in Germany!

With a commitment to transparency and client-focused solutions, we guide you through every step of your investment portfolio journey. Our advisors are not tied to specific products or providers, ensuring you receive unbiased advice that puts your financial well-being first.

-

Specialized in working with expats

8 years of experience working with expats in Germany.

-

Experienced with investment portfolios

+5 Mio. Euros under management

-

Certified financial advisors

All our financial advisors are certified according to §34d and §34f GewO.

Get professional and objective advice!

Start fighting inflation with an optimized investment portfolio.

Real Estate vs. Stock Market

The Value Appreciation of Residential Real Estate in Germany: Dream vs. Reality

FAQS

Answer the most frequently asked questions

Have questions about working with a financial advisor in Berlin? Here we answer the most common questions about our services, process, and what you can expect when partnering with Finanz2go.

Are you truely independent?

We are independent consultants, as we do not work for any product provider like an insurance or a bank, so we do not have to sell any products. We are registered with the Chamber of Commerce and Industry as an independent financial broker. This means that we are “fiduciary trustees” of our clients. We are therefore legally obligated to find suitable solutions for your situation and your needs. In doing so, we draw on virtually the entire investment, finance and insurance market. For us, this means true independence.

Can I save taxes with my investment?

Yes you can. In Germany there are huge tax advantages and incentives for long term investing. Depending on what fits your individual situation we choose a framework that makes the most sense for you. Investment plans that you can deduct from your tax especially are interesting for high earners and freelancers due to their high tax burden.

How can I lower my tax burden?

The German tax system is progressive, meaning that the more you make, the higher is your marginal tax rate. Fortunately, you can use this to your advantage by taking advantage of deductions to lower your tax burden, for example by investing in a Base pension. You get a tax refund of up to 42% of your contribution (income <60k). Change your mindset from complaining about taxes to using the German tax system, and you will financially benefit.

How do we get paid?

All cost of the provider, the funds as well as for the advisor are already included in the pension plan. We get paid in government regulated commissions by the insurance when you decide to do the plan. The conditions you get with us are exactly the same you get with the insurance directly, so you have no financial disadvantage by doing the plan with us, but of course the huge advantage is that we as independent brokers can scan the whole market, so you get the best available option.

What happens when I leave Germany?

The solutions in our consulting are structured in a way that you are flexible should you choose to leave Germany during your working life, and you can get your pension anywhere in the world.

Financial Advisor News

Get professional knowledge on your phone.

Resources:

📚 Foundational Texts

- An Introduction to Investment Theory

A comprehensive online textbook by William N. Goetzmann from Yale School of Management, covering topics like portfolio theory, asset pricing, and risk-return trade-offs.

🔗 Read the full text here - Understanding Investments: Theories and Strategies

This resource offers an in-depth exploration of classic investment theories and strategies, providing a solid foundation for both students and practitioners.

🔗 Access the publication on ResearchGate - Generally Accepted Investment Theories

A document by the U.S. Department of Labor discussing optimal asset allocation and portfolio theory, useful for understanding investment strategies in retirement planning.

🔗 Download the PDF