If you are living in Berlin and need some help with your money, Finanz2Go might be exactly what you are looking for. This company gives personal advice made for your specific needs. It does not matter if you are an expat, work for yourself, or just want to get a better handle on your money in Germany. Let’s see what they do and why they could be a good choice for you.

About Finanz2Go

About Finanz2go – Meet our team!

At Finanz2go, we specialize in providing transparent, independent financial advice tailored to the needs of expats, employees, and self-employed professionals living in Germany. Based in Berlin, we are certified under §34f GewO and committed to helping our clients make informed long-term financial decisions.

services

We help expats who want to stay in Germany long-term.

Looking for a professional financial advisor Berlin?

At Finanz2go, we provide independent, transparent advice to help you invest smart, plan your retirement, and secure your future. Our English-speaking financial advisors in Berlin are here to support expats and professionals alike.

01. investment portfolio

Start your investment portfolio

As your financial advisor in Berlin, we help you build a tailored investment portfolio aligned with your goals, risk profile, and time horizon. Our approach focuses on long-term growth, diversification, and cost-efficiency.

02. pension plan

Tax-Optimized investment plan

As your trusted financial advisor in Berlin, we help you navigate the complex German pension system and build a customized retirement strategy. We guide you in choosing the right mix of private and state-supported pension options.

03. wealth management

Personal Wealth Management

Starting from €100,000, our wealth management service offers personalized investment strategies to grow and protect your assets. As your financial advisor in Berlin, we focus on long-term planning, tax efficiency, and transparent advice tailored to your goals.

Key Takeaways

- Finanz2Go is an independent financial advisor, meaning their advice is only for your needs. They are not tied to banks or insurance companies.

- They make personal money plans that are just for expats and people who live here.

- You can expect clear advice with no hidden fees. Everything is out in the open.

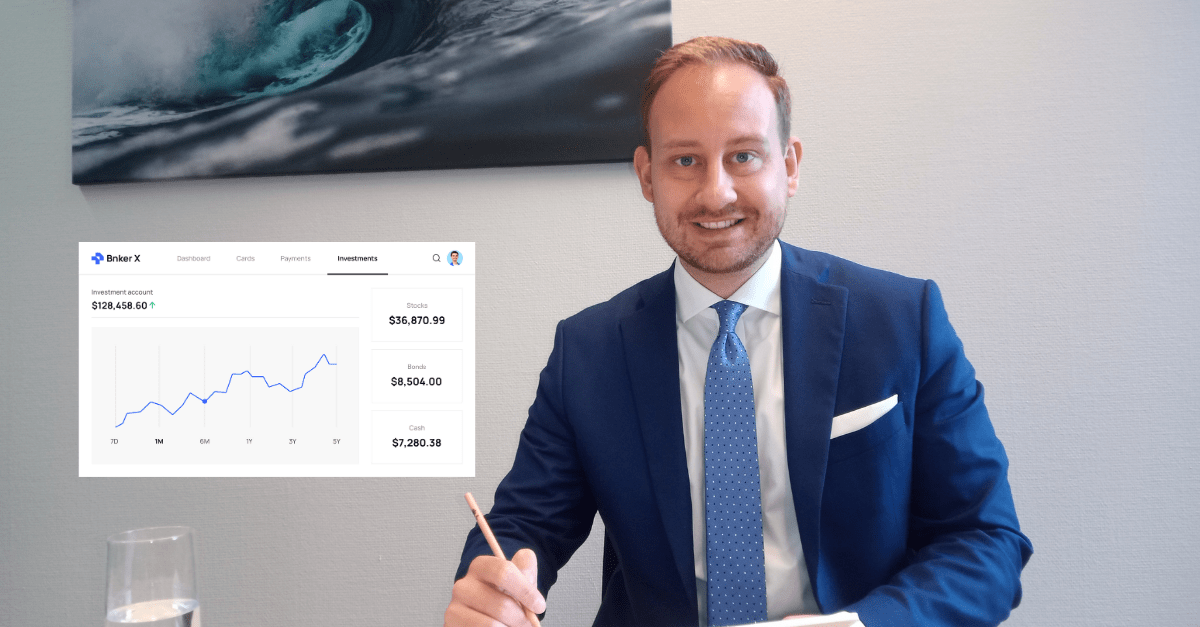

- Their easy-to-use online platform lets you see your investments as they happen.

- The team at Finanz2Go is experienced and wants to help you reach your money goals.

- They help you understand German money rules, which can be tricky for expats.

- You can get advice in English, which is really helpful if German isn’t your first language.

- They help you plan for retirement and make sure your future in Germany is secure.

Understanding Finanz2Go’s Core Philosophy

Finanz2Go operates on a set of core principles designed to provide the best possible financial guidance, especially for expats in Berlin. It’s about more than just numbers; it’s about understanding your individual situation and helping you achieve your financial goals. We aim to be a reliable partner in your financial journey, offering support and clarity every step of the way.

Independent Advisory Services

We pride ourselves on being completely independent. This means we aren’t tied to any specific banks, insurance companies, or financial products. Our advice is driven solely by what’s best for you, ensuring unbiased recommendations tailored to your unique circumstances. This independence is fundamental to our approach.

Client-Centric Financial Strategies

Your needs always come first. We take the time to understand your individual financial situation, goals, and risk tolerance. This allows us to develop strategies that are specifically designed to help you achieve your objectives, whether it’s saving for a down payment on a house, planning for retirement, or simply getting a better handle on your day-to-day finances.

Transparent Fee Structures

We believe in complete transparency when it comes to our fees. You’ll always know exactly what you’re paying for, with no hidden charges or surprises. Our fee structure is designed to be fair and competitive, reflecting the value of the services we provide. We want you to feel confident that you’re getting excellent value for your money.

Real-Time Investment Tracking

Stay informed about your investments with our user-friendly online platform. You can monitor your portfolio’s performance in real-time, access detailed reports, and track your progress towards your financial goals. This level of transparency and control empowers you to make informed decisions about your financial future.

Experienced Financial Professionals

Our team consists of highly qualified and experienced financial professionals who are dedicated to providing you with the best possible advice. We stay up-to-date on the latest market trends and regulatory changes, ensuring that you receive informed and relevant guidance. All our financial advisors are trained and certified according to §34d and §34f GewO.

Personalised Financial Roadmaps

We don’t believe in one-size-fits-all solutions. We work with you to create a personalised financial roadmap that outlines your goals, strategies, and timeline for success. This roadmap serves as a guide to keep you on track and motivated as you work towards achieving your financial aspirations.

Unbiased Financial Guidance

Because we are independent, our guidance is always unbiased. We don’t have any hidden agendas or conflicts of interest. Our only goal is to help you make the best possible financial decisions for your specific situation. You can trust that our recommendations are based solely on your needs and objectives.

Holistic Financial Planning

We take a holistic approach to financial planning, considering all aspects of your financial life. This includes your income, expenses, assets, liabilities, insurance, and estate planning needs. By looking at the big picture, we can develop strategies that are comprehensive and effective in helping you achieve your long-term financial goals.

Finanz2Go is committed to providing clear, honest, and reliable financial advice to expats in Berlin. We understand the unique challenges and opportunities that come with living and working abroad, and we’re here to help you navigate the complexities of the German financial system.

Tailored Financial Planning for Expats

Moving to a new country is a big deal, and sorting out your finances can feel like climbing a mountain. That’s where tailored financial planning comes in, especially if you’re an expat. It’s not just about managing money; it’s about understanding a whole new system.

Navigating German Financial Regulations

German financial rules can be tricky. It’s not the same as back home, is it? We can help you understand the ins and outs, from taxes to investments. It’s about making sure you’re not caught out by something you didn’t know. Understanding local financial laws is key to financial compliance in Germany.

Specialised Expat Financial Solutions

Generic financial advice doesn’t always cut it. Expats have unique needs, like dealing with different currencies or planning for a future that might involve moving again. We look at your specific situation to find the best solutions. This means plans that fit your life, not someone else’s.

Addressing Unique Expat Needs

What are your goals? Buying a place? Sending money home? Retirement? We’ll help you figure out what’s important to you and create a plan to get there. It’s about more than just saving; it’s about achieving your dreams. German Sherpa understands the unique financial needs of expats.

Cross-Border Financial Considerations

Dealing with money in multiple countries can be a headache. We can help you manage your finances across borders, making sure you’re not losing out on exchange rates or getting hit with unexpected taxes. It’s about making things as smooth as possible.

Language-Specific Financial Advice

Trying to understand complex financial terms in a new language? No thanks! We offer advice in English, so you know exactly what’s going on. No jargon, just clear explanations. We specialise in English-Speaking Financial Advisors for expats.

Residency-Based Financial Planning

Whether you’re here for a year or planning to stay forever, your financial plan should reflect that. We’ll help you create a strategy that works for your residency status and your long-term goals. It’s about planning for the future, whatever it holds.

Integrating Home Country Finances

It’s important to keep your finances back home in mind. We can help you integrate your existing accounts and investments into your German financial plan. This ensures everything works together, rather than against each other. We help expats who want to stay in Germany long-term.

Building a Robust Investment Portfolio

Building a solid investment portfolio is key to achieving your long-term financial goals. It’s not just about picking stocks; it’s about creating a strategy that aligns with your personal circumstances and risk tolerance. Let’s explore how Finanz2Go can help you build a portfolio that works for you.

Strategic Investment Portfolio Development

We start by understanding your financial situation, goals, and time horizon. This helps us create a strategic investment portfolio investment portfolio tailored to your specific needs. It’s about more than just picking investments; it’s about building a plan that helps you achieve your objectives.

Aligning Investments with Personal Goals

Your investments should directly support your personal goals, whether it’s buying a home, funding your children’s education, or securing a comfortable retirement. We work with you to define these goals and then select investments that are most likely to help you achieve them. It’s a very personal process, and we take the time to get it right.

Assessing Risk Tolerance for Growth

Understanding your risk tolerance is crucial. Are you comfortable with the possibility of losing money in exchange for higher potential returns, or do you prefer a more conservative approach? We use questionnaires and discussions to assess your risk tolerance and then build a portfolio that reflects your comfort level. This ensures you won’t lose sleep over market fluctuations.

Diversification Strategies for Stability

Diversification is key to managing risk. By spreading your investments across different asset classes, industries, and geographic regions, you can reduce the impact of any single investment performing poorly. We use a range of diversification strategies to help you build a stable and resilient portfolio.

Cost-Efficient Investment Approaches

High fees can eat into your investment returns over time. We focus on cost-efficient investment approaches, such as using low-cost index funds and ETFs, to minimise expenses and maximise your returns. We believe that keeping costs down is essential for long-term success.

Long-Term Wealth Accumulation

Our focus is on long-term wealth accumulation. We don’t chase short-term gains or fads. Instead, we build portfolios that are designed to grow steadily over time, helping you achieve your financial goals. It’s a marathon, not a sprint.

Market Analysis and Insights

We provide regular market analysis and insights to help you understand what’s happening in the financial markets and how it might affect your portfolio. We don’t just tell you what to invest in; we explain why. This helps you make informed decisions and stay on track with your financial plan. Financial advisors in Germany can help you stay informed.

Regular Portfolio Reviews

Your financial situation and goals may change over time, so it’s important to review your portfolio regularly. We offer regular portfolio reviews to ensure that your investments are still aligned with your needs and that you’re on track to achieve your goals. We’ll help you make adjustments as needed to keep you moving forward.

Building a robust investment portfolio is a journey, not a destination. It requires careful planning, ongoing monitoring, and a willingness to adapt to changing circumstances. With Finanz2Go, you’ll have a partner to guide you every step of the way.

Comprehensive Retirement and Pension Planning

Planning for retirement can feel like a daunting task, especially when you’re navigating a new country and its financial systems. At Finanz2Go, we aim to simplify this process, providing you with the knowledge and support needed to secure your financial future in Germany. We understand the intricacies of the German pension system and can help you make informed decisions about your retirement savings.

Customised Pension Strategies

Everyone’s retirement goals are different, so a one-size-fits-all approach simply won’t do. We work with you to develop custom retirement and pension planning strategies that align with your specific needs and aspirations. This involves assessing your current financial situation, understanding your desired retirement lifestyle, and creating a plan to bridge any gaps.

Understanding German State Pension System

The German state pension system (Gesetzliche Rentenversicherung) is a key component of retirement planning in Germany. It’s important to understand how it works, what contributions you’re making, and what benefits you can expect to receive. We can help you decipher the complexities of the system and ensure you’re making the most of it. It’s worth noting that the state pension alone might not be enough to maintain your desired lifestyle in retirement.

Exploring Private Pension Options

In addition to the state pension, there are various private pension options available in Germany, such as Riester-Rente, Rürup-Rente, and private life insurance policies. Each option has its own advantages and disadvantages, and the best choice for you will depend on your individual circumstances. We can help you understand local financial laws and explore these options to determine which ones are most suitable for your needs.

Investment-Based Retirement Solutions

For many, investment-based retirement solutions offer the potential for higher returns and greater flexibility. This could involve investing in stocks, bonds, or other assets through a private pension plan or a separate investment account. We can help you develop an investment strategy that aligns with your risk tolerance and retirement goals, ensuring you’re on track to achieve long-term financial security.

Securing Your Future in Germany

Our goal is to help you secure your financial future in Germany, providing you with the peace of mind that comes from knowing you’re well-prepared for retirement. This involves not only building a robust pension pot but also considering other factors such as healthcare costs, long-term care needs, and potential tax implications.

Early Retirement Planning

Thinking about retiring early? It’s a great goal, but it requires careful planning. We can help you assess the feasibility of early retirement, taking into account your current savings, projected expenses, and potential income streams. We’ll also help you understand the implications of retiring early on your state pension benefits.

Pension Transfer Advice

If you’ve worked in other countries and have existing pension pots, you may be able to transfer them to Germany. We can provide advice on the pension transfer advice process, helping you navigate the complexities of international pension transfers and ensure you’re making the best decision for your retirement.

Maximising Retirement Income

Ultimately, the goal of retirement planning is to maximise your retirement income, ensuring you have enough money to live comfortably throughout your retirement years. We can help you develop a withdrawal strategy that optimises your income while minimising your tax liability. We can also help you explore other potential income streams, such as rental income or part-time work.

Retirement planning is a marathon, not a sprint. It requires careful planning, consistent effort, and a long-term perspective. With our support, you can navigate the complexities of the German financial system and build a secure and fulfilling retirement.

Key Benefits of Partnering with Finanz2Go

Choosing a financial advisor can feel like a big decision, especially when you’re trying to sort out your finances in a new country. At Finanz2Go, we aim to make that choice easier by offering a range of benefits designed to support expats and locals alike. We focus on providing clear, unbiased advice to help you achieve your financial goals.

Independent and Transparent Advice

We pride ourselves on being fully independent. This means we aren’t tied to any banks, insurance companies, or specific financial products. Our recommendations are based solely on what’s best for you and your individual circumstances. You can trust that our advice is unbiased and focused on helping you reach your financial objectives. We believe in transparent advice so you always know where you stand.

Expertise in German Financial System

Navigating the German financial system can be tricky, with its own set of rules and regulations. Our team has in-depth knowledge of the local landscape, from understanding tax implications to making the most of available investment opportunities. We can guide you through the complexities and ensure you’re making informed decisions that are right for you. We help you understand the German financial system so you can make informed decisions.

English-Speaking Financial Advisors

Language barriers can add an extra layer of stress when dealing with finances. That’s why we have a team of fluent English-speaking financial advisors who can communicate clearly and effectively with you. We’ll explain everything in plain English, so you fully understand your options and can make confident decisions about your money.

Custom Retirement and Pension Planning

Retirement might seem far off, but it’s never too early to start planning. We offer custom retirement and pension planning services tailored to your specific needs and goals. Whether you’re looking to understand the German state pension system or explore private pension options, we can help you create a strategy that secures your future.

Personalised Investment Strategies

Investing can feel overwhelming, but it doesn’t have to be. We work with you to develop personalised investment strategies that align with your risk tolerance, financial goals, and time horizon. We’ll help you build a diversified portfolio that aims to grow your wealth over the long term, while also managing risk effectively.

Support for Employees and Freelancers

Whether you’re an employee or a freelancer, we understand the unique financial challenges you face. We offer tailored support to help you manage your income, optimise your taxes, and plan for your future. We can provide guidance on everything from setting up a budget to investing for retirement.

Clear Communication and Guidance

We believe in clear and open communication. We’ll explain complex financial concepts in a way that’s easy to understand, and we’ll always be available to answer your questions and provide guidance. We want you to feel empowered and in control of your finances.

Dedicated Client Support

We’re committed to providing dedicated client support every step of the way. Whether you have a quick question or need more in-depth assistance, our team is here to help. We value building long-term relationships with our clients and providing ongoing support to help them achieve their financial goals.

Partnering with Finanz2Go means gaining a trusted advisor who understands your unique needs and is committed to helping you achieve financial success in Germany. We offer a combination of expertise, personalised service, and clear communication to empower you to make informed decisions about your money.

Navigating German Bureaucracy and Regulations

Moving to a new country always comes with its fair share of paperwork and legal hoops to jump through. Germany is no exception. For expats, understanding and complying with German bureaucracy and regulations is vital for a smooth and stress-free experience. It can seem daunting at first, but with the right guidance, it’s definitely manageable.

Understanding Local Financial Laws

German financial laws can be complex, even for locals. It’s important to get to grips with the key legislation that affects your finances, from income tax to investment regulations. Ignorance isn’t bliss when it comes to the law, and failing to comply can lead to penalties.

Compliance with German Tax System

The German tax system is notoriously intricate. Understanding your tax obligations, including income tax, VAT (if you’re self-employed), and church tax (if applicable), is crucial. Make sure you’re aware of the deadlines for filing your tax returns and paying your taxes. It might be worth looking into tax optimisation for self-employed to make sure you’re not paying more than you need to.

Simplifying Administrative Processes

Dealing with German authorities often involves a lot of paperwork and red tape. Try to streamline the administrative processes as much as possible. This might involve gathering all the necessary documents in advance, using online portals where available, and seeking assistance from professionals who are familiar with the system.

Guidance on Financial Documentation

Having the right financial documentation is essential for various purposes, such as opening a bank account, applying for a loan, or filing your taxes. Make sure you keep all your financial records organised and easily accessible. This includes payslips, bank statements, investment statements, and tax returns.

Adhering to Investment Regulations

If you’re planning to invest in Germany, it’s important to be aware of the relevant investment regulations. These regulations are designed to protect investors and ensure the integrity of the financial markets. Make sure you understand the rules regarding disclosure requirements, insider trading, and market manipulation.

Ensuring Legal Financial Practises

It’s vital to ensure that all your financial practises are legal and ethical. This means avoiding tax evasion, money laundering, and other illegal activities. If you’re unsure about the legality of a particular financial transaction, seek advice from a qualified professional.

Avoiding Common Pitfalls

Expats often fall into common pitfalls when dealing with German bureaucracy and regulations. These might include failing to register their address, not understanding their tax obligations, or making mistakes on official forms. Being aware of these pitfalls can help you avoid costly errors. It’s easy to make mistakes due to unfamiliarity with local laws.

Expert Regulatory Interpretation

German regulations can be open to interpretation, and it’s not always easy to understand how they apply to your specific situation. Seeking expert regulatory interpretation from a qualified professional can help you navigate the complexities of the system and ensure that you’re in compliance. Finanz2Go can help expats livingermany.de with these processes.

Personalised Financial Strategies for Individuals

We all have different things we want to achieve in life, and that includes our finances. That’s why a one-size-fits-all approach simply doesn’t cut it. At Finanz2Go, we focus on crafting financial strategies that are as unique as you are. It’s about understanding your specific situation, your goals, and your dreams, and then building a plan to help you get there.

Tailored Financial Roadmaps

Think of this as your personal financial GPS. We’ll work with you to map out your financial journey, identifying key milestones and plotting the best route to reach them. This isn’t just about numbers; it’s about creating a clear, actionable plan that you understand and feel confident in. We start with an initial consultation and assessment to understand your needs.

Goal-Oriented Financial Planning

What do you want to achieve? A deposit on a flat? Early retirement? Funding your children’s education? Your goals are the driving force behind your financial plan. We’ll break down your aspirations into manageable steps, setting realistic targets and tracking your progress along the way.

Budgeting and Cash Flow Management

Understanding where your money is going is the first step to taking control of your finances. We can help you create a budget that works for you, identifying areas where you can save and optimising your cash flow to achieve your financial goals. It’s about making informed choices and saving money in Germany without feeling restricted.

Debt Management Solutions

Debt can be a major obstacle to financial freedom. We can help you develop a strategy to manage your debt effectively, whether it’s consolidating loans, negotiating lower interest rates, or creating a repayment plan that fits your budget. It’s about taking proactive steps to reduce your debt burden and improve your overall financial health. We can help you with tax optimisation for self-employed.

Savings Optimisation

Are you making the most of your savings? We can help you identify opportunities to optimise your savings strategy, whether it’s opening a high-yield savings account, investing in tax-efficient vehicles, or simply automating your savings contributions. It’s about making your money work harder for you and building wealth in Germany.

Wealth Preservation Techniques

Once you’ve built your wealth, it’s important to protect it. We can help you implement strategies to preserve your wealth for the long term, such as estate planning, insurance coverage, and asset protection measures. It’s about safeguarding your financial future and ensuring that your wealth is passed on to future generations. Consider the Generation Consultation for long-term planning.

Financial Education and Empowerment

We believe that financial literacy is key to making informed decisions and achieving your financial goals. We’ll provide you with the knowledge and resources you need to understand complex financial concepts, make sound investment choices, and take control of your financial future. It’s about empowering you to make confident decisions and retiring comfortably.

Adapting to Life Changes

Life is full of surprises, and your financial plan should be flexible enough to adapt to changing circumstances. Whether you’re starting a new job, getting married, having children, or facing unexpected expenses, we’ll work with you to adjust your plan accordingly and ensure that you stay on track to achieve your goals.

We aim to be more than just your financial advisor; we want to be your partner in that destination and provide you with the map and directions to reach it.

The Importance of Independent Financial Advice

Unbiased Recommendations

When it comes to your money, you want to know the advice you’re getting is solid. That’s where independent financial advice comes in. It’s all about getting recommendations that aren’t skewed by any hidden agendas or affiliations. You need someone who’s truly on your side, looking out for your best interests. For example, if you’re an expat and need to verify your life insurance policy’s validity, an unbiased advisor can help you understand the fine print.

Freedom from Bank Affiliations

One of the biggest advantages of independent financial advice is the freedom from being tied to a specific bank or financial institution. This means the advisor isn’t pressured to push certain products or services just because they benefit the bank. Instead, they can explore a wider range of options to find the best fit for your unique situation. It’s like having a personal shopper for your finances, someone who can pick and choose from the entire market.

No Hidden Agendas

Let’s be honest, the financial world can be a bit murky. It’s easy to feel like you’re not getting the full story. Independent advisors are committed to transparency. They don’t have hidden agendas or secret incentives that could compromise their advice. This means you can trust that their recommendations are based solely on what’s best for you, not their own pockets. If you’re self-employed, you’ll want to ensure tax optimisation for self-employed is part of the plan.

Focus on Client’s Best Interests

At the end of the day, independent financial advice is all about putting the client first. It’s about taking the time to understand your individual goals, needs, and risk tolerance, and then crafting a financial plan that’s tailored specifically to you. It’s a client-centric approach that prioritises your financial well-being above all else.

Objective Market Analysis

Independent advisors aren’t limited to the research and analysis provided by a single institution. They have access to a broader range of market data and insights, allowing them to provide a more objective and well-rounded perspective. This can be especially helpful when making important investment decisions.

Diverse Product Selection

Because they’re not tied to any particular company, independent advisors can offer a diverse selection of financial products and services. This means they can find the best solutions from across the entire market, rather than being limited to a specific range of options. This flexibility can be a huge advantage when building a comprehensive financial plan.

Ethical Financial Practises

Independent financial advisors are held to a high standard of ethical conduct. They’re required to act in your best interests at all times, and they’re subject to regulatory oversight to ensure they’re doing so. This commitment to ethical practises provides peace of mind and helps build a strong, trusting relationship. If you’re an expat with questions, a good advisor will have answers to common questions from expats.

Building Trust and Confidence

Ultimately, the goal of independent financial advice is to build trust and confidence. When you know you’re getting unbiased, objective advice from someone who’s truly on your side, you can feel more secure about your financial future. This peace of mind is invaluable, especially in today’s uncertain world.

Choosing an independent advisor means you get advice that’s truly focused on your needs. They aren’t tied to specific products or companies, so they can offer recommendations that are genuinely in your best interest. It’s like having someone on your side, making sure you get the best possible solutions.

Managing Your Finances as a Self-Employed Professional

Being self-employed in Berlin offers freedom, but it also means taking full responsibility for your finances. It can feel overwhelming at times, but with the right approach, you can achieve financial stability and growth.

Financial Planning for Freelancers

Freelancers often face irregular income, making budgeting a challenge. Creating a detailed budget is the first step towards managing your finances effectively. This involves tracking income and expenses to identify areas where you can save. Consider using budgeting apps or spreadsheets to stay organised. It’s also a good idea to set aside a percentage of each payment for taxes and future investments. Understanding the nuances of freelancing in Germany is key to getting started on the right foot.

Income Volatility Management

Income volatility is a common concern for self-employed individuals. To mitigate this, consider:

- Building an emergency fund to cover unexpected expenses or periods of low income.

- Diversifying your income streams by offering different services or products.

- Creating a savings plan to set aside money during high-income months to cover leaner periods.

Tax Optimisation for Self-Employed

Taxes can be a significant burden for the self-employed. It’s important to understand the German tax system and take advantage of available deductions. This might involve:

- Tracking all business-related expenses, such as office supplies, travel, and software.

- Consulting with a tax advisor to identify potential deductions and credits.

- Making estimated tax payments throughout the year to avoid penalties.

Business Expense Management

Managing business expenses effectively is crucial for profitability. Keep detailed records of all expenses, and separate personal and business finances. This will simplify tax preparation and provide a clear picture of your business’s financial health. Consider using accounting software or hiring a bookkeeper to help with this process. Xolo can provide expert accounting support for freelancers.

Retirement Planning for Entrepreneurs

Retirement planning is often overlooked by the self-employed, but it’s essential to secure your future. Explore different retirement options, such as:

- Private pension plans (private Rentenversicherung).

- Investment-based retirement accounts.

- Contributing to the German state pension system (gesetzliche Rentenversicherung), if eligible.

Investment Strategies for Business Owners

As a business owner, your investment strategy should align with your financial goals and risk tolerance. Consider diversifying your investments across different asset classes, such as stocks, bonds, and property. It’s also important to regularly review your portfolio and make adjustments as needed. For funding inquiries, you can call for direct assistance.

Securing Future Income Streams

To secure future income streams, consider:

- Developing passive income sources, such as online courses or rental properties.

- Building a strong client base to ensure a steady flow of work.

- Investing in your skills and knowledge to remain competitive in your industry.

Separating Personal and Business Finances

It’s crucial to separate personal and business finances to maintain accurate records and simplify tax preparation. Open a separate business bank account and use it exclusively for business transactions. This will also help you track your business’s financial performance and make informed decisions. Renewing a freelance visa often requires a tax advisor, so keeping finances separate is essential.

Managing your finances as a self-employed professional requires discipline and planning. By implementing these strategies, you can achieve financial stability and build a secure future for yourself and your business.

Understanding Investment Platforms for Expats

Choosing the right investment platform is a big deal, especially when you’re an expat trying to navigate a new financial landscape. There are loads of options out there, each with its own quirks and features. It’s not just about finding something that works; it’s about finding something that works for you in your specific situation.

Selecting Suitable Investment Platforms

Finding the right platform starts with knowing what you need. Are you after something simple for basic investing, or do you want all the bells and whistles for advanced trading? Consider the types of investments you’re interested in – stocks, ETFs, or maybe even crypto. Your investment goals will heavily influence which platform is the best fit. Think about things like minimum investment amounts and account fees too.

Platforms with English Language Support

Language can be a major barrier. Luckily, many platforms offer English language support, making things a whole lot easier. Look for platforms with interfaces and customer service in English. This can save you a lot of headaches when you’re trying to understand complex financial information or sort out any issues.

Accessibility for Non-Residents

Not all platforms are created equal when it comes to accessibility for non-residents. Some might have restrictions on who can open an account, so it’s important to check the fine print. Make sure the platform allows you to invest from your current residency status and that it complies with any relevant tax regulations. For your first bank account, select an expat-friendly option.

Fee Structures of Various Platforms

Fees can eat into your returns, so it’s worth understanding how each platform charges. Look at transaction fees, account maintenance fees, and any other hidden costs. Some platforms offer commission-free trading, but they might make up for it in other ways, like higher fees for certain services. Transparency is key here.

Security and Regulation of Platforms

Security should be a top priority. Check that the platform is regulated by a reputable financial authority and that it has measures in place to protect your data and investments. Look for things like two-factor authentication and secure data encryption. It’s always better to be safe than sorry when it comes to your money. Futures.io offers a valuable German subforum for investors.

User Experience and Interface

A clunky, confusing interface can make investing a real pain. Choose a platform that’s easy to use and navigate, especially if you’re new to investing. Many platforms offer demo accounts, so you can try before you commit. A good user experience can make all the difference.

Diversification Options on Platforms

Diversification is a cornerstone of smart investing. Check what range of assets you can access on the platform. Can you invest in a variety of stocks, bonds, and funds? The more options you have, the easier it is to spread your risk and build a well-rounded portfolio. We help you to build a diversified investment portfolio.

Customer Support for Expats

Good customer support is essential, especially when you’re dealing with financial matters in a foreign country. Look for platforms that offer responsive and helpful support in English. Check if they have live chat, email, or phone support, and read reviews to see what other expats have to say about their experiences. eToro’s app is highlighted as the top investment choice in Germany.

Choosing the right investment platform is a personal decision. Take your time, do your research, and don’t be afraid to ask questions. The goal is to find a platform that fits your needs and helps you achieve your financial goals in Germany.

Long-Term Financial Security in Berlin

Strategies for Sustainable Growth

Building long-term financial security in Berlin requires a well-thought-out plan. It’s not just about earning a good income; it’s about making smart choices with your money to ensure it grows sustainably over time. This involves understanding the German economic landscape and identifying opportunities for growth that align with your personal circumstances. Consider factors like inflation, interest rates, and market trends to make informed decisions.

Protecting Your Assets

Protecting your assets is a critical component of long-term financial security. This means taking steps to safeguard your wealth from potential risks, such as market volatility, legal liabilities, and unforeseen events. Insurance plays a key role here, covering areas like health, property, and liability. Diversification of investments is also essential to mitigate risk and protect your portfolio from significant losses.

Inflation Hedging Techniques

Inflation can erode the value of your savings over time, so it’s important to implement strategies to hedge against it. Investing in assets that tend to hold their value or increase in value during inflationary periods is one approach. These assets might include real estate, commodities, or inflation-indexed bonds. Regularly reviewing your investment portfolio and adjusting it to account for inflation is crucial for maintaining your purchasing power.

Estate Planning Considerations

Estate planning is often overlooked but is a vital part of securing your long-term financial future. It involves making arrangements for the distribution of your assets after your death, ensuring that your wishes are carried out and that your loved ones are taken care of. This includes creating a will, setting up trusts, and considering inheritance tax implications. Seeking professional legal advice is recommended to ensure your estate plan is comprehensive and legally sound.

Intergenerational Wealth Transfer

For some, long-term financial security also involves planning for the transfer of wealth to future generations. This requires careful consideration of tax implications, legal requirements, and family dynamics. Strategies for intergenerational wealth transfer might include gifting assets during your lifetime, establishing trusts, or creating a family foundation. The goal is to ensure that your wealth is preserved and passed on in a way that benefits your heirs and aligns with your values.

Emergency Fund Planning

An emergency fund is a crucial safety net that can protect you from unexpected financial setbacks. It should be readily accessible and sufficient to cover several months‘ worth of living expenses. This fund can help you avoid going into debt or liquidating investments during emergencies, such as job loss, medical expenses, or unexpected repairs. Aim to build an emergency fund that provides peace of mind and financial stability.

Financial Resilience Building

Building financial resilience means developing the ability to withstand financial shocks and adapt to changing circumstances. This involves having a diversified income stream, managing debt effectively, and maintaining a healthy savings rate. It also requires staying informed about financial matters and being proactive in addressing potential risks. Financial resilience is key to navigating life’s uncertainties and achieving long-term financial security. Consider getting financial planning support to help you.

Adapting to Economic Changes

The economic landscape is constantly evolving, so it’s important to be adaptable and adjust your financial strategies accordingly. This means staying informed about economic trends, market conditions, and regulatory changes. It also requires being willing to re-evaluate your investment portfolio, adjust your spending habits, and seek professional advice when needed. Adapting to economic changes is essential for maintaining long-term financial security in a dynamic world.

Securing your financial future in Berlin requires a proactive and informed approach. By implementing these strategies, you can build a strong financial foundation and achieve long-term financial security, regardless of economic uncertainties.

Here’s a simple table illustrating the importance of starting early with investments:

| Age Starting | Monthly Investment | Years to Retirement | Total Invested | Estimated Return (7%) |

|---|---|---|---|---|

| 25 | 300 | 40 | 144,000 | 680,000 |

| 35 | 300 | 30 | 108,000 | 340,000 |

| 45 | 300 | 20 | 72,000 | 160,000 |

Consider these points when planning your finances:

- Regularly review your financial plan.

- Seek professional advice when needed.

- Stay informed about financial matters.

Transparent Cost Structure and Fees

It’s really important to know where your money is going, especially when you’re dealing with financial planning. At Finanz2Go, we believe in being upfront about all our costs. No one likes surprises when it comes to fees, so we make sure everything is clear from the start. We want you to feel confident and in control of your finances.

Clear Explanation of Charges

We provide a detailed breakdown of all our charges. This means you’ll know exactly what you’re paying for. We’ll walk you through each item, so you understand how our fees work. It’s all about making sure you’re comfortable with the investment strategies we recommend.

Absence of Front-End Loads

We don’t charge any front-end loads. This means you won’t pay a fee just to get started with us. We believe in earning your trust and business through the value we provide, not through initial charges.

No Redemption Fees

If you ever need to access your funds, we won’t penalise you with redemption fees. We understand that circumstances change, and you should be able to withdraw your money without incurring extra costs. It’s part of our commitment to being client-focused.

Performance-Related Cost Transparency

Any performance-related costs are fully transparent. We’ll explain how these costs are calculated and when they apply. This ensures you understand how our success impacts our fees, aligning our interests with yours. We want you to understand the German tax system and how it affects your investments.

Competitive Annual Charges

Our annual charges are competitive within the industry. We regularly review our fees to ensure they offer good value for the services we provide. We aim to provide top-notch financial advice without breaking the bank.

Value for Money Services

We focus on providing value for money. This means we strive to deliver high-quality financial planning services that justify the fees you pay. We want you to feel that you’re getting a worthwhile return on your investment in our services.

Avoiding Hidden Costs

We are committed to avoiding hidden costs. What you see is what you get. We believe in honesty and integrity in our fee structure, so you can trust that there won’t be any unexpected charges down the line. It’s all part of building a strong, transparent relationship with our clients. We can also help you with offshore banking if that’s something you’re interested in.

Detailed Fee Breakdowns

We provide detailed fee breakdowns in all our statements and reports. This allows you to easily see exactly what you’re paying and how it’s calculated. We believe in empowering you with the information you need to make informed financial decisions.

Understanding the costs associated with financial planning is crucial. We aim to provide clear, concise information so you can make informed decisions about your financial future. We want to help you manage your cost of living effectively.

Here’s a quick summary of what you can expect:

- Clear explanations of all charges

- No hidden fees or surprises

- Competitive and fair pricing

Leveraging Technology for Financial Management

Technology has changed how we handle our finances, and at Finanz2Go, we’re all about using these tools to help you reach your financial goals. It’s not just about having a fancy app; it’s about making smart decisions with the right information at your fingertips. Let’s explore how we use tech to make your financial life easier.

User-Friendly Online Platform

Our online platform is designed to be easy to use, even if you’re not a tech expert. It’s the central hub for all your financial information, giving you a clear overview of your investments, plans, and progress. We believe that financial management should be accessible to everyone, and our platform reflects that.

Real-Time Investment Monitoring

With our platform, you can keep an eye on your investments in real-time. This means you’re always up-to-date on how your portfolio is performing, allowing you to make informed decisions. Real-time data helps you react quickly to market changes and stay on track with your financial goals.

Digital Access to Financial Data

Say goodbye to piles of paperwork! All your financial documents and reports are stored securely online, accessible whenever you need them. This digital access makes it easy to review your financial history, track your spending, and plan for the future. It’s all about convenience and control.

Secure Online Communication

We use secure channels for all our online communication, ensuring your personal and financial information stays safe. Whether you’re sending us a message or participating in a video call, you can trust that your privacy is protected. Security is our top priority.

Automated Financial Reporting

Our system generates automated financial reports, giving you a clear picture of your financial health. These reports are easy to understand and provide valuable insights into your spending, saving, and investment habits. Automated reporting saves you time and helps you stay organised.

Mobile Accessibility for Convenience

Manage your finances on the go with our mobile app. Whether you’re checking your investment portfolio or reviewing your budget, our app puts everything you need right in your pocket. Mobile accessibility means you can stay connected to your finances, no matter where you are.

Integrating Financial Tools

We integrate various financial tools and resources into our platform, making it a one-stop shop for all your financial needs. From budgeting calculators to retirement planning tools, we provide the resources you need to make informed decisions. Integration simplifies your financial life.

Data Privacy and Security

We take data privacy and security very seriously. We use advanced encryption and security measures to protect your personal and financial information. You can trust that your data is safe with us. We adhere to strict data protection regulations to ensure financial compliance and your peace of mind.

Technology is a powerful tool, but it’s only as good as the people using it. At Finanz2Go, we combine cutting-edge technology with expert financial advice to help you achieve your goals. We’re here to guide you every step of the way.

Here’s a quick look at the benefits of using our tech-driven approach:

- Convenience: Access your financial information anytime, anywhere.

- Transparency: See exactly where your money is going and how your investments are performing.

- Security: Rest assured that your data is protected with advanced security measures.

Expert Guidance for Diverse Financial Needs

We understand that everyone’s financial situation is unique. That’s why Finanz2Go is committed to providing expert guidance tailored to your specific needs and circumstances. We aim to address even the most complex financial scenarios with clarity and precision.

Addressing Complex Financial Scenarios

Life isn’t always straightforward, and neither are finances. We’re equipped to handle intricate situations, offering clear and actionable advice when you need it most. This includes things like navigating international tax laws or managing assets across multiple countries. We can help you understand the implications of each decision and make informed choices.

Specialised Advice for High Net Worth Individuals

For those with substantial assets, preserving and growing wealth requires a sophisticated approach. We offer Investment Consulting services designed to meet the unique challenges and opportunities faced by high net worth individuals. This includes estate planning, tax optimisation, and risk management strategies.

Support for Varying Income Levels

Whether you’re just starting out or have a well-established career, we can help you manage your finances effectively. We provide guidance on budgeting, saving, and investing, regardless of your income level. Our goal is to help you build a solid financial foundation and achieve your long-term goals.

Guidance for Different Life Stages

Your financial needs will change as you move through different stages of life. We offer tailored advice for each stage, from buying your first home to planning for retirement. We can help you anticipate future needs and make adjustments to your financial plan as necessary.

Adapting to Market Fluctuations

The financial markets can be volatile, and it’s important to have a strategy in place to manage risk. We provide ongoing monitoring and adjustments to your investment portfolio to help you stay on track, even during periods of market uncertainty. We can help you understand the factors that drive market movements and make informed decisions about your investments.

Proactive Financial Problem Solving

We don’t just react to problems; we anticipate them. We work with you to identify potential financial risks and develop strategies to mitigate them. This includes things like creating an emergency fund, purchasing insurance, and diversifying your investments.

Continuous Professional Development

To provide the best possible advice, we are committed to continuous professional development. We stay up-to-date on the latest financial trends, regulations, and investment strategies. This ensures that we can provide you with the most relevant and effective guidance.

Collaborative Client Relationships

We believe in building strong, collaborative relationships with our clients. We take the time to understand your individual needs and goals, and we work with you to develop a financial plan that reflects your values and priorities. We are always available to answer your questions and provide support.

We aim to be more than just your financial advisor; we want to be your partner in that destination and provide you with the map and directions to reach it.

Here’s how we can help:

- Provide unbiased advice financial advice for expats

- Develop tailored strategies

- Offer ongoing support

The Process of Engaging with Finanz2Go

Initial Consultation and Assessment

It all starts with a conversation. We want to understand your current financial situation, your goals, and what you hope to achieve. This initial consultation is a chance for you to ask questions and for us to determine if we’re the right fit for you. We’ll discuss your income, expenses, assets, and liabilities to get a clear picture of where you stand. This is also where we’ll touch on your risk tolerance and investment experience.

Defining Financial Goals

What do you want your money to do for you? Are you saving for a deposit on a flat, planning for retirement, or looking to invest for the long term? We’ll work with you to define specific, measurable, achievable, relevant, and time-bound (SMART) goals. These goals will form the foundation of your financial plan. It’s important to have a clear vision of what you want to achieve, whether it’s retirement planning or something else entirely.

Developing a Customised Plan

Based on our initial assessment and your financial goals, we’ll develop a personalised financial plan tailored to your unique circumstances. This plan will outline specific strategies and recommendations to help you achieve your objectives. It will cover areas such as budgeting, saving, investing, and debt management. This plan is not a one-size-fits-all solution; it’s designed specifically for you.

Implementation of Strategies

Once you’re happy with the plan, we’ll help you put it into action. This may involve opening investment accounts, adjusting your budget, or making changes to your insurance coverage. We’ll guide you through each step of the process and provide ongoing support to ensure that you stay on track.

Ongoing Monitoring and Adjustments

Your financial plan is not set in stone. As your life changes, so too will your financial needs. We’ll regularly monitor your progress and make adjustments to your plan as needed. This ensures that your plan remains relevant and effective over time. We’ll also keep you informed of any changes in the market or regulations that may impact your finances.

Regular Client Meetings

We believe in building long-term relationships with our clients. We’ll schedule regular meetings to review your progress, discuss any concerns, and make any necessary adjustments to your plan. These meetings are an opportunity for you to ask questions and receive ongoing support and guidance.

Responsive Communication Channels

We’re always here to answer your questions and provide support. We offer a variety of communication channels, including phone, email, and video conferencing. We strive to respond to your inquiries promptly and efficiently. We understand that financial matters can be complex, and we’re committed to providing clear and concise explanations.

Feedback and Improvement Cycles

We value your feedback and are always looking for ways to improve our services. We encourage you to share your thoughts and suggestions with us. We use your feedback to refine our processes and ensure that we’re meeting your needs. We are committed to providing the best possible service and are always striving to improve.

Engaging with a financial advisor is a big step. We aim to make the process as straightforward and stress-free as possible. Our goal is to help you achieve your financial goals and build a secure future.

Here’s a quick overview of what you can expect:

- Initial consultation: Free and no obligation.

- Personalised plan: Tailored to your needs.

- Ongoing support: We’re here for you every step of the way.

Ensuring Financial Compliance in Germany

It’s easy to get lost in the world of German finance, especially if you’re new here. Making sure you’re following all the rules and regulations is super important to avoid any nasty surprises down the line. Finanz2Go can help you stay on the right side of the law.

Understanding German Financial Laws

German financial laws can seem complicated, but they’re there to protect everyone. It’s important to know your rights and responsibilities. These laws cover everything from banking and investments to taxes and insurance. Getting to grips with the basics is the first step to expat financial planning success.

Compliance with German Tax System

The German tax system is residency-based, meaning if you live here, you’re taxed on your worldwide income. Understanding how this works is vital. You’ll need to get to grips with things like income tax, capital gains tax, and maybe even church tax. Don’t forget to check if you need to file a tax return as a non-resident.

Simplifying Administrative Processes

Dealing with German bureaucracy can be a headache. There’s a lot of paperwork involved, and it’s often in German. Finanz2Go can help simplify these processes, guiding you through the necessary steps and forms. This can save you a lot of time and stress.

Guidance on Financial Documentation

Keeping your financial documents in order is essential. This includes bank statements, investment records, and tax returns. Make sure you have a system for storing these documents safely and securely. Good record-keeping will make your life much easier when it comes to filing taxes or applying for loans.

Adhering to Investment Regulations

Investing in Germany comes with its own set of rules and regulations. You need to be aware of these to avoid any legal issues. This includes understanding the different types of investments available and the risks involved. It’s also important to make sure your investments are compliant with German law.

Ensuring Legal Financial Practises

It’s crucial to ensure that all your financial activities are legal and above board. This means avoiding tax evasion, money laundering, and other illegal activities. If you’re unsure about something, it’s always best to seek professional advice.

Avoiding Common Pitfalls

There are several common pitfalls that expats can fall into when it comes to their finances in Germany. This includes not understanding the tax system, failing to declare foreign income, and not having adequate insurance. Being aware of these pitfalls can help you avoid them.

Expert Regulatory Interpretation

Regulatory interpretation can be tricky, especially when dealing with complex financial matters. Finanz2Go can provide expert guidance on interpreting German financial regulations. This can help you make informed decisions and stay compliant with the law. They can help you understand the German tax system and how it applies to your situation.

Staying on top of financial compliance in Germany is a continuous process. Laws and regulations can change, so it’s important to stay informed and seek professional advice when needed. This will help you protect your assets and avoid any legal problems.

Building a Strong Financial Foundation

It’s easy to get caught up in the day-to-day, but taking the time to build a solid financial base is super important. It’s not just about having money; it’s about having a plan and feeling secure about your future. Let’s break down some key steps to get you started.

Establishing Core Financial Principles

Think of these as your financial commandments. They’re the guiding rules that will keep you on track. It’s about deciding what’s important to you – maybe it’s saving for a house, early retirement, or just having peace of mind. Whatever it is, write it down and make it your focus. Understanding client goals is the first step.

Creating a Solid Budget

Budgeting doesn’t have to be a drag. It’s simply about knowing where your money is going. Use an app, a spreadsheet, or even just a notebook – whatever works for you. Track your income and expenses for a month to see where you can cut back. You might be surprised at how much you’re spending on things you don’t even need.

Prioritising Savings and Investments

Pay yourself first! Before you spend on anything else, put money into savings or investments. Even a small amount each month can add up over time. Consider setting up automatic transfers so you don’t even have to think about it. Look into robo advisor in Germany for a tech-driven alternative.

Managing Debt Effectively

Debt can be a real drag on your finances. High-interest debt, like credit cards, should be your first priority. Make a plan to pay it off as quickly as possible. Consider consolidating your debt or transferring balances to lower-interest cards. Don’t take on more debt than you can handle. We can also help you understand your options for accessing emergency funds or restructuring debt if necessary.

Building an Emergency Fund

Life happens. Cars break down, appliances die, and unexpected medical bills pop up. That’s why it’s crucial to have an emergency fund. Aim for at least 3-6 months‘ worth of living expenses in a readily accessible account. This will prevent you from going into debt when the unexpected happens.

Understanding Financial Products

There are so many financial products out there – savings accounts, ISAs, pensions, investments, insurance… It can be overwhelming! Take the time to learn about the different options and how they work. Don’t be afraid to ask for help from a financial advisor. Get professional and objective advice about your finances.

Developing Financial Discipline

This is where the rubber meets the road. It’s about sticking to your budget, resisting impulse buys, and making smart financial decisions. It’s not always easy, but it’s worth it in the long run. Remember your financial goals and keep them in mind when you’re tempted to stray.

Setting Realistic Financial Goals

Dream big, but be realistic. Don’t set goals that are so ambitious that you’ll get discouraged. Start with small, achievable goals and gradually increase them as you make progress. Celebrate your successes along the way to stay motivated. Setting clear financial goals is key.

Financial planning is a continuous process, not a one-off event. Life changes, and so should your plan. Regular reviews are key to staying on track.

Building a strong financial foundation takes time and effort, but it’s one of the best investments you can make in your future. It’s about being prepared and knowing what steps to take when things get tough.

Client Testimonials and Success Stories

Real-World Client Experiences

It’s easy for a company to say they’re great, but what truly matters is what the clients think. At Finanz2Go, we’ve assisted many people in achieving their financial aspirations, and we take pride in the outcomes. Our clients‘ experiences speak volumes about the quality and impact of our services.

Demonstrated Financial Achievements

We’re not just about giving advice; we’re about seeing real, tangible results. Consider David and Emily, a young couple who came to us struggling to save for a deposit on a house. After creating customised investment plans and sticking to it, they managed to save enough for a deposit within three years. Or consider Mrs. Patel, who was worried about her retirement. We helped her consolidate her pensions and create a retirement planning strategy that gave her peace of mind. These case studies show how tailored advice can make a real difference.

Positive Feedback from Expats

Many expats find the German financial system daunting. We’re proud to have helped over 500 expats in Germany navigate these complexities. Here’s a snippet of what they have to say:

- „Finanz2Go really helped me understand my options as an expat. They took the time to get to know me and my goals, and they created a plan that was perfect for me.“

- „I feel so much more confident about my financial future now that I’m working with Finanz2Go.“

- „Björn is top-notch. I have to say I’m an experienced investor, but since I moved to Germany, I needed some help to understand the local rules.“

Case Studies of Financial Growth

Let’s delve into a specific example. Sarah, a freelancer, was struggling with income volatility management. We helped her create a budget and savings plan that allowed her to build a financial cushion for leaner months. Within a year, she had a solid emergency fund and felt much more secure about her financial future.

Building Long-Term Client Relationships

We’re not just about quick wins; we’re about building lasting relationships. We schedule regular check-ins to see how things are going and make any necessary adjustments. Maybe you’ve had a career change, started a family, or are getting closer to retirement. Whatever it is, we’ll adapt your financial strategy to fit your current situation. Many of our clients have been with us for years, and we’ve helped them through various life stages. Here’s what keeps them coming back:

- Personalised attention

- Proactive advice

- Consistent results

It’s important to remember that financial planning is a process, not a one-time event. Your needs and goals will change over time, so it’s important to review your plan regularly and make adjustments as needed.

Impact of Personalised Advice

Personalised advice can make a significant difference in achieving financial goals. Whether it’s saving for a home, planning for retirement, or managing debt, a tailored approach can help you stay on track and reach your objectives more efficiently.

Client Satisfaction Metrics

We continuously monitor client satisfaction to ensure we’re meeting their needs and expectations. Our client satisfaction scores consistently rank high, reflecting our commitment to providing excellent service and support.

Referrals and Recommendations

One of the biggest compliments we receive is when our clients refer us to their friends and family. These referrals are a testament to the trust and confidence they have in our services.

Future-Proofing Your Financial Health

It’s easy to get caught up in day-to-day finances, but taking a step back to think about the future is really important. It’s about making sure you’re prepared for whatever life throws your way, and that your money is working hard for you, not the other way around. Let’s look at some key areas to consider when future-proofing your financial health.

Anticipating Economic Shifts

No one has a crystal ball, but keeping an eye on economic trends can help you prepare. Are interest rates rising? Is inflation a concern? Understanding these shifts allows you to make informed decisions about your investments and spending. It’s about being proactive, not reactive. For example, if you anticipate a recession, you might want to consider shifting some of your investments into more stable assets. Staying informed is key.

Adapting Investment Strategies

Your investment strategy shouldn’t be set in stone. As you get older, or as the market changes, you’ll need to adjust your approach. What worked in your 20s might not be suitable in your 40s or 50s. It’s about finding the right balance between risk and reward, and making sure your investments align with your long-term goals. We can help you with investment strategies tailored to your needs.

Planning for Unexpected Events

Life is full of surprises, and not all of them are good. Having a financial safety net can help you weather unexpected storms, whether it’s a job loss, a medical emergency, or a major home repair. An emergency fund is essential, and it should cover at least 3-6 months of living expenses. It’s also worth considering insurance policies to protect against other potential risks.

Long-Term Wealth Preservation

Building wealth is one thing, but preserving it is another. This involves protecting your assets from taxes, inflation, and other threats. It might involve strategies like diversifying your investments, using tax-advantaged accounts, or creating a trust. It’s about making sure your wealth lasts for generations to come.

Succession Planning Considerations

Succession planning isn’t just for businesses; it’s also important for individuals. It involves deciding what will happen to your assets when you’re gone. This might involve creating a will, setting up trusts, or making other arrangements to ensure your wishes are carried out. It’s a difficult topic to think about, but it’s important to have a plan in place.

Staying Ahead of Inflation

Inflation erodes the value of your money over time. To combat this, you need to make sure your investments are growing faster than the rate of inflation. This might involve investing in assets that tend to perform well during inflationary periods, such as property or commodities. It’s about protecting your purchasing power.

Continuous Financial Education

The world of finance is constantly evolving, so it’s important to stay informed. Read books, attend seminars, and follow reputable financial news sources. The more you know, the better equipped you’ll be to make sound financial decisions. Don’t be afraid to ask questions and seek advice from professionals.

Building a Legacy

Think about what you want to leave behind. Do you want to support a particular cause? Do you want to provide for your family? Building a legacy involves making conscious decisions about how you want your wealth to be used after you’re gone. It’s about leaving a lasting impact on the world.

Financial planning is a continuous process, not a one-off event. Life changes, and so should your plan. Regular reviews are key to staying on track.

Here’s a simple table illustrating the impact of inflation on your savings:

| Year | Savings | Inflation Rate | Value After Inflation |

|---|---|---|---|

| 1 | £10,000 | 3% | £9,700 |

| 5 | £10,000 | 3% | £8,626 |

| 10 | £10,000 | 3% | £7,374 |

To future-proof your finances, consider these steps:

- Create a detailed budget.

- Automate your savings.

- Review your financial strategy regularly.

- Seek professional advice when needed.

Expats looking to buy property in Germany often face challenges with financing due to bank requirements. Switching to German private health insurance is typically less expensive than the statutory type for single, high-income employees. This guide helps expats navigate living in Germany, offering comprehensive information on housing, healthcare, work culture, and practical tips.

Accessing Professional Financial Planning Support

It can be daunting trying to sort out your finances, especially in a new country. Luckily, Finanz2Go is here to help. We aim to make accessing professional financial planning support as straightforward as possible, so you can focus on enjoying your life in Berlin. We offer a range of options to suit your needs and preferences.

Booking an Initial Appointment

Getting started with Finanz2Go is easy. You can book an initial appointment through our website, by phone, or by sending us an email. This first meeting is a chance for us to understand your current financial situation and what you hope to achieve. It’s also an opportunity for you to ask any questions you might have about our services and how we can help you. We want you to feel comfortable and informed from the very beginning. You can explore insurance options with our team.

Online Consultation Options

For those who prefer the convenience of remote meetings, we offer online consultation options. Using secure video conferencing, you can speak with a Financial Advisor from the comfort of your own home. This is a great option if you have a busy schedule or if you live outside of Berlin. We use screen sharing to review documents and discuss your financial plan in detail, just as we would in person.

In-Person Meetings in Berlin

If you prefer face-to-face interaction, we are happy to arrange in-person meetings at our Berlin office. This allows for a more personal connection and the opportunity to discuss your finances in a relaxed and confidential setting. Our office is conveniently located and easily accessible by public transport. We can discuss financial planning services in person.

Dedicated Advisor Availability

When you partner with Finanz2Go, you’ll be assigned a dedicated advisor who will be your main point of contact. This ensures consistency and a strong understanding of your individual needs. Your advisor will be available to answer your questions, provide guidance, and support you throughout your financial journey. They’ll be there to help you find support and advice.

Responsive Communication Channels

We understand that timely communication is important. That’s why we offer a range of responsive communication channels, including phone, email, and secure messaging. We aim to respond to your inquiries promptly and efficiently, so you can always stay informed about your finances.

Access to Educational Resources

We believe that informed clients make better financial decisions. That’s why we provide access to a range of educational resources, including articles, guides, and webinars. These resources are designed to help you understand complex financial concepts and make informed choices about your money. We want to empower you to take control of your financial future.

Ongoing Support and Guidance

Financial planning is an ongoing process, not a one-time event. We provide ongoing support and guidance to help you stay on track with your financial goals. We’ll regularly review your plan, make adjustments as needed, and provide advice on any new financial challenges or opportunities that may arise.

Seamless Onboarding Process

We’ve designed our onboarding process to be as smooth and hassle-free as possible. We’ll guide you through each step, from gathering the necessary documents to setting up your accounts. Our goal is to make the transition to Finanz2Go as easy and stress-free as possible, so you can start benefiting from our services right away. A Financial Planner can help you with this process.

Getting professional financial advice doesn’t have to be complicated. At Finanz2Go, we’re committed to providing accessible, reliable, and personalised support to help you achieve your financial goals in Berlin.

Wrapping Things Up

So, if you’re living in Berlin and thinking about your money, Finanz2Go could be a good choice. They give advice that’s just for you, whether you’re new to Germany or have been here a while. Because they don’t work for banks or insurance companies, you know their advice is honest. Plus, their online system makes it easy to see how your money is doing. If you want to get your finances sorted and plan for the future, getting in touch with Finanz2Go might be a smart move. They’re there to help you every step of the way.

Frequently Asked Questions

What services does Finanz2Go offer?

Finanz2Go provides a range of financial services, including personal financial advice, retirement planning, and investment strategies, all designed to fit your unique needs.

Is Finanz2Go truly an independent financial advisor?

Yes, Finanz2Go is completely independent. This means they are not tied to any banks or insurance companies, so their advice is always fair and unbiased.

How can a financial planner help me?

A financial planner can help you understand your money choices, create a plan for your future, and make smart decisions about your finances.

Do you offer services for expats?

Absolutely! Finanz2Go specialises in helping expats understand and manage their money in Germany, making sure they get the right advice for their personal situations.

Are there any hidden fees with your services?

No, Finanz2Go believes in being open and clear. All their fees are explained upfront, so you always know exactly what you are paying for.

Can I track my investments online?

Yes, Finanz2Go has an easy-to-use online platform where you can check your investments whenever you want.

How does Finanz2Go help build a strong financial foundation?

Finanz2Go helps you build a strong financial foundation by setting clear goals, managing your budget, and choosing smart investments.

Do you provide financial planning for self-employed professionals?

Yes, Finanz2Go offers special advice for self-employed individuals, helping them with things like managing income, reducing taxes, and planning for retirement.

How does technology help with financial management at Finanz2Go?

Finanz2Go uses modern technology, like their online platform, to make managing your money easier and more convenient, allowing you to access your financial information securely anytime.

How does Finanz2Go ensure financial compliance in Germany?

Their advisors are experts in German financial rules and regulations, ensuring that all your financial activities are legal and compliant.

What kind of ongoing support can I expect?

Finanz2Go offers ongoing support, regular meetings, and responsive communication to ensure your financial plan stays on track and adjusts to any life changes.