If you’re living in Germany and looking for a reliable way to manage your investments, Finanz2Go could be just what you need. This portfolio manager offers a range of services tailored specifically for expats and locals alike. With a team of dedicated financial advisors, they aim to simplify your investment journey and help you achieve your financial goals without the usual headaches.

Key Takeaways

- Finanz2Go provides tailored portfolio management services for both expats and residents in Germany.

- The firm offers access to over 10,000 investment funds and integrates the latest market research into its strategies.

- Their financial advisors focus on understanding individual client needs to create personalised investment plans.

- Regular portfolio reviews are part of their service, ensuring your investments remain aligned with your goals.

- The team at Finanz2Go is multilingual, making financial advice accessible for clients from various backgrounds.

services

We help expats who want to stay in Germany long-term.

Looking for a professional financial advisor Berlin?

At Finanz2go, we provide independent, transparent advice to help you invest smart, plan your retirement, and secure your future. Our English-speaking financial advisors in Berlin are here to support expats and professionals alike.

01. investment portfolio

Start your investment portfolio

As your financial advisor in Berlin, we help you build a tailored investment portfolio aligned with your goals, risk profile, and time horizon. Our approach focuses on long-term growth, diversification, and cost-efficiency.

02. pension plan

Tax-Optimized investment plan

As your trusted financial advisor in Berlin, we help you navigate the complex German pension system and build a customized retirement strategy. We guide you in choosing the right mix of private and state-supported pension options.

03. wealth management

Personal Wealth Management

Starting from €100,000, our wealth management service offers personalized investment strategies to grow and protect your assets. As your financial advisor in Berlin, we focus on long-term planning, tax efficiency, and transparent advice tailored to your goals.

Comprehensive Portfolio Management Services

At Finanz2Go, we understand that managing your portfolio can be complex, especially when navigating the German financial landscape. That’s why we provide a suite of services designed to simplify the process and help you achieve your financial goals. We aim to provide clear, actionable advice, so you can make informed decisions about your money.

Investment and Pension Planning

We offer detailed investment and pension planning services tailored to your specific needs and risk tolerance. This includes assessing your current financial situation, defining your objectives, and creating a roadmap to reach them. We consider factors like your age, income, and long-term goals to develop a plan that works for you. It’s about setting you up for a comfortable retirement and financial security.

Sustainable Investing Strategies

More and more people want their investments to reflect their values. We can help you build a portfolio that aligns with your ethical considerations while still aiming for strong returns. This involves selecting funds and companies that prioritise environmental, social, and governance (ESG) factors. It’s about making a positive impact with your money.

Wealth Management Solutions

Our wealth management solutions are designed for individuals and families with more complex financial needs. This includes estate planning, tax optimisation, and strategies for preserving and growing your wealth over generations. We work closely with you to understand your unique circumstances and develop a plan that addresses your specific concerns. We also consider wealth management services to help you find the best strategy.

We believe in a holistic approach to wealth management, considering all aspects of your financial life to create a cohesive and effective plan.

Here’s a quick look at what our wealth management solutions can include:

- Financial Planning: Creating a comprehensive plan tailored to your goals.

- Investment Management: Managing your investments to maximise returns while minimising risk.

- Estate Planning: Ensuring your assets are distributed according to your wishes.

- Tax Optimisation: Minimising your tax burden through strategic planning.

Real Estate vs. Stock Market

The Value Appreciation of Residential Real Estate in Germany: Dream vs. Reality

Expertise in Financial Advisory

We reckon that good financial advice is more than just picking stocks; it’s about understanding your life goals and helping you get there. We aim to provide advice that’s both informed and easy to understand.

Tailored Investment Strategies

Everyone’s different, right? So, we don’t do one-size-fits-all. We take the time to understand what you want to achieve, your risk tolerance, and your current situation. Then, we build an investment strategy that fits you like a glove. It’s about making sure your money works as hard as you do. You can find a list of financial advisors in Germany that offer similar services.

Long-Term Asset Accumulation

We’re not about quick wins or chasing the latest fad. We’re in it for the long haul. Our focus is on helping you build wealth steadily over time. This means smart, considered investments, regular reviews, and adjustments as needed. Think of it as planting a tree – it takes time and care to grow, but the rewards are worth it. We can help you with investment and pension plan.

Collaborative Client Engagement

We believe in working with you, not just for you. We want you to understand what we’re doing and why. We’ll explain things clearly, answer your questions honestly, and keep you updated every step of the way. It’s your money, and you should feel in control. We’re here to guide you and provide financial consultancy along the way.

We think that open communication and a strong relationship are key to successful financial planning. We want you to feel comfortable talking to us about your concerns and aspirations. After all, it’s a partnership.

Innovative Investment Solutions

We get it, the world of finance can feel a bit…stuck in the past. That’s why at Finanz2Go, we’re all about bringing you investment solutions that are as forward-thinking as you are. We want to make investing easier and more effective.

Access to Over 10,000 Investment Funds

Seriously, we mean it. You’ll have a huge range of options. Whether you’re into established blue-chip companies or want to explore emerging markets, we’ve got funds to match your interests and risk tolerance. It’s like having a massive investment supermarket at your fingertips. You can find the best investment strategy for your goals.

Integration of Capital Market Research

We don’t just throw darts at a board. Our investment decisions are backed by solid capital market research. We’re constantly analysing trends, economic indicators, and global events to make sure your portfolio is positioned for success. It’s about making smart, informed choices, not just hoping for the best. We also consider cultural considerations in financial planning.

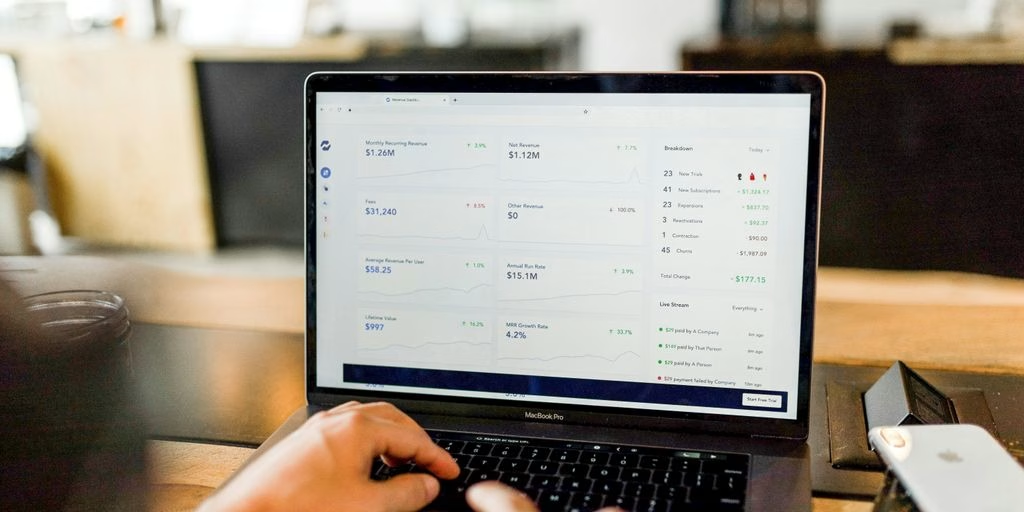

Online Portfolio Management Tools

Say goodbye to complicated spreadsheets and endless paperwork. Our online tools give you a clear, real-time view of your portfolio’s performance. You can track your investments, monitor your progress towards your goals, and make adjustments as needed – all from the comfort of your own home. It’s about putting you in control. We want to help you with long-term asset strategies.

We believe that everyone deserves access to sophisticated investment tools and insights. Our innovative solutions are designed to make investing more accessible, transparent, and ultimately, more rewarding.

Here’s a quick look at some of the features you can expect:

- User-friendly interface

- Customisable dashboards

- Secure data encryption

- Mobile accessibility

Dedicated Support for Expats

Moving to a new country is exciting, but sorting out your finances in a new language and system? That can be a bit of a headache. At Finanz2Go, we get that. We’ve built our services to specifically help expats like you manage your money and plan for the future here in Germany. It’s not just about investments; it’s about making life easier.

Understanding Expat Financial Needs

We know that expats have unique financial situations. You might be dealing with international money transfers, figuring out the German tax system, or planning for retirement both here and back home. That’s why we take the time to really listen and understand your specific needs. We can help you with tax optimisation, insurance, and finding the right investments.

Bespoke Financial Planning

There’s no one-size-fits-all solution when it comes to financial planning. We create plans that are tailored to your individual goals and circumstances. Whether you’re saving for a deposit on a house, planning for your children’s education, or just want to make sure you’re making the most of your money, we can help. We can also assist expat families and young professionals in Germany overcoming financial challenges.

Multilingual Advisory Services

Language shouldn’t be a barrier to getting good financial advice. Our team includes advisors who speak English fluently, so you can discuss your finances comfortably and confidently. We can connect you with English-speaking tax consultants and financial advisors who understand the German system.

We aim to provide clear, straightforward advice in a language you understand. We want you to feel in control of your finances, no matter where you’re from.

We also understand the importance of community. We can point you to resources like Cologne Expats to help you settle in and connect with other internationals. We want to be more than just your financial advisor; we want to be a part of your support network. We can also connect you with expat-friendly financial advisors to assist with managing your finances.

The Team Behind Finanz2Go

Finanz2Go isn’t just about algorithms and investment strategies; it’s about the people driving it. We believe that trust and understanding are key to successful financial planning, and that starts with our team.

Co-Founders‘ Vision

At the helm of Finanz2Go are Fabian Beining and Björn Tappe. Their vision was simple: to provide clear, unbiased financial advice to expats in Germany. They recognised a gap in the market for accessible, English-speaking financial services, and set out to create a company that puts clients first. They’ve been working hard since June 2023 to make Finanz2Go what it is today.

Experienced Financial Advisors

Our team comprises seasoned financial advisors with a wealth of knowledge in German financial regulations and investment opportunities. Each advisor is dedicated to providing personalised guidance, ensuring that every client receives the attention and support they deserve. We’re a diverse bunch, but we all share a common goal: helping you achieve your financial aspirations.

Commitment to Client Success

Client success isn’t just a buzzword for us; it’s at the heart of everything we do. We measure our success by your success, and we’re committed to providing the tools and support you need to reach your financial goals. We’re in it for the long haul, and we’re here to help you every step of the way.

We believe in building long-term relationships with our clients, based on trust, transparency, and mutual respect. Your financial well-being is our top priority, and we’ll always go the extra mile to ensure you’re satisfied with our services.

Here’s a little breakdown of what we focus on:

- Clear communication

- Personalised strategies

- Ongoing support

Client-Centric Approach to Portfolio Management

At Finanz2Go, we believe that portfolio management should revolve around you. It’s not just about numbers and charts; it’s about understanding your goals, your risk tolerance, and your dreams for the future. We put you, the client, at the heart of everything we do.

Objective Financial Product Comparisons

We don’t push specific products. Instead, we conduct objective advice across a wide range of financial products. This means we look at everything available to find the best fit for your individual needs. We take the time to explain the pros and cons of each option, so you can make informed decisions. It’s about transparency and trust, ensuring you understand where your money is going and why.

Personalised Investment Plans

Your investment plan shouldn’t be a cookie-cutter solution. We craft tailored support that reflects your unique circumstances. This involves:

- A detailed assessment of your financial situation.

- Setting clear, achievable goals.

- Developing a strategy that aligns with your risk appetite.

- Regular communication and adjustments as needed.

We understand that life changes, and your investment plan should adapt accordingly. Whether you’re saving for a house, retirement, or your children’s education, we’ll work with you to create a plan that evolves with your needs.

Regular Portfolio Reviews

The financial landscape is constantly shifting, so we conduct regular portfolio reviews. These reviews help us:

- Monitor your portfolio’s performance.

- Identify potential risks and opportunities.

- Make necessary adjustments to keep you on track.

- Ensure data availability is up to date.

We’ll sit down with you to discuss the results of each review, explaining our recommendations in plain English. Our aim is to keep you informed and in control, every step of the way.

Navigating the German Financial Landscape

Understanding Local Regulations

Okay, so you’re thinking about getting your finances sorted in Germany? First thing’s first: you need to get your head around the rules. Germany is pretty strict when it comes to financial stuff, and it’s not always easy to figure out what’s what. You’ll want to look into things like tax laws, investment regulations, and all that jazz. It can be a bit of a minefield, but it’s important to get it right. For example, understanding compliance in Germany is key to avoiding issues.

Investment Opportunities in Germany

Germany’s not all rules and regulations, though. There are some good chances to grow your money if you know where to look. You could consider:

- Real estate: Property can be a solid investment, especially in bigger cities.

- Stocks and bonds: The German stock market has its ups and downs, but it’s worth checking out.

- Investment funds: These can be a good way to spread your risk.

Just remember, every investment comes with risks, so do your homework before you jump in. It’s also worth noting that Germany’s economy faces economic challenges that could impact your investments.

Cultural Considerations in Financial Planning

Germans tend to be pretty cautious when it comes to money. They like to plan ahead and avoid unnecessary risks. This means you might need to adjust your approach to financial planning to fit in with the local culture. For example, they might be more interested in long-term security than quick profits. Also, keep in mind that the 2025 Coalition Agreement could bring changes that affect financial planning.

It’s also worth noting that there are many financial services in Berlin that can help you navigate the German financial landscape. Don’t hesitate to seek professional advice, especially if you’re an expat trying to understand the system. And if you’re considering real estate investments, be sure to factor in the cultural nuances of the German market.

Understanding the financial world in Germany can be tricky, especially for newcomers. It’s important to know how to manage your money wisely and make the best choices for your future. If you’re looking for help with your finances, visit our website to learn more about how we can assist you in navigating this landscape effectively. Don’t miss out on the chance to secure your financial future!

Final Thoughts on Finanz2Go

In conclusion, Finanz2Go stands out as a reliable partner for expats in Germany looking to manage their investments effectively. With a dedicated team of English-speaking advisors, they focus on creating tailored investment strategies that align with individual financial goals. Their approach combines thorough market research with a wide selection of over 10,000 investment funds, ensuring clients have access to the best options available. Whether you’re just starting out or looking to refine your existing portfolio, Finanz2Go offers the expertise and support needed to navigate the complexities of investment management in Germany.

Frequently Asked Questions

What services does Finanz2Go provide?

Finanz2Go offers a range of services including investment planning, pension advice, and wealth management tailored to individual needs.

How can Finanz2Go help expats in Germany?

The team at Finanz2Go understands the unique financial needs of expats and provides customised financial planning and advice in English.

What investment options are available through Finanz2Go?

Clients can access over 10,000 investment funds and benefit from the latest market research to make informed decisions.

How does Finanz2Go create personalised investment strategies?

Finanz2Go works closely with clients to understand their financial goals and crafts tailored investment plans that suit their unique situations.

Can I manage my portfolio online with Finanz2Go?

Yes, Finanz2Go provides online tools that allow clients to manage their portfolios conveniently from anywhere.

What makes Finanz2Go different from other financial advisors?

Finanz2Go focuses on a client-centred approach, offering objective comparisons of financial products and regular reviews to ensure clients stay on track with their goals.